Introduction to market interest rate expectations

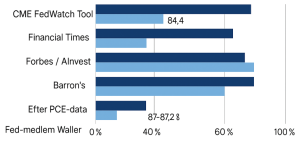

The market's eyes are on the Federal Reserve ahead of its September 2025 meeting. The question on everyone's mind is: will the Fed cut its key interest rate by 0.25 percentage points? According to several market indicators, the probability points strongly in that direction. However, depending on which source you review, the estimates vary between 75 and 90%.

Interest rate cuts affect not only the bond market but also stocks, currencies and commodities, so the market weighs every new data point, from inflation reports to labor market statistics, with great care.

What is the CME FedWatch Tool?

How the tool works

The CME FedWatch Tool is based on price data from Fed Funds futures. By analyzing how investors position themselves in these contracts, it can calculate the probability of different interest rate decisions from the Fed.

Why investors are following it closely

Because the tool provides a real-time view of market consensus, it has become a central reference point. Banks, hedge funds, and analysts use it to calibrate their forecasts and investment strategies.

Current probabilities according to the CME FedWatch Tool

-

84.4 % probability for a cut of 0.25 percentage points in September.

-

15.6 % chance that the interest rate is left unchanged.

This means that the market is almost fully pricing in a cut, but leaves the door open for a scenario where the Fed wants to wait for further data.

Comparison with other market assessments

Financial Times: 75 % probability

The FT reports a slightly more cautious market view: around a 75% chance of a cut.

Barron's: 90 % chance of reduction + subsequent reductions

A much more optimistic picture comes from Barron's. They state a 90% probability of a September cut, and a whopping 86% probability of another cut before the end of the year.

Forbes and AInvest: 86 % probability

Forbes and the analysis firm AInvest place the probability in the middle range, around 86 %.

After PCE data: 87–87.2 % chance

After the latest PCE inflation report – a key measure for the Fed – the probability increased slightly further. According to Politico and The Tradable, the market's assessment is now at 87-87.2 %.

Fed members' insight

Christopher Waller: support for 25-point cut

Fed Governor Christopher Waller has expressed his support for a 25-point cut as early as September.

Signals of more cuts ahead

Waller has also indicated that more cuts may be in the works over the next 3–6 months, especially if the labor market continues to weaken.

Overall overview of forecasts

| Source | Probability of reduction in September 2025 |

|---|---|

| CME FedWatch Tool | 84,4 % |

| Financial Times | 75 % |

| Forbes / AInvest | 86 % |

| Barron's | 90 % (sequence reduction: 86 %) |

| After PCE data | 87–87.2 % |

| Fed member Waller | Support for 25-point reduction |

Factors driving expectations

Inflation trends and PCE data

The latest PCE report shows stable inflation, which strengthens the Fed's room for cuts.

Labor market weakness

A weakening labor market is another key factor. If employment continues to weaken, pressure on the Fed to act will increase.

Global economy and the strength of the dollar

A strong dollar and uncertain global economic conditions contribute to the market almost unanimously expecting easing in monetary policy.

How investors should interpret the signals

Stock market reactions

Equities often benefit from lower interest rates as financing costs fall and valuations strengthen.

The fixed income market and bond yields

Lower policy rates pressure returns on short-term bonds but can provide support for longer maturities.

Currency market expectations

A cut could weaken the dollar, which in turn could strengthen commodities and export-driven economies.

Conclusion: Fed on track for September cut

Overall, the market is broadly in agreement: the probability of a September rate cut is very high, with estimates ranging from 75 to 90 %. CME FedWatch is at 84.4 % – the most conservative forecast – while Barron's paints a near-certain scenario of 90 %.

The Fed's own representatives, such as Christopher Waller, are strengthening expectations by clearly signaling support for a 25-point cut. With a weaker labor market and stable inflation, everything points to the Fed taking its first step towards easier monetary policy in September.

❓ Frequently Asked Questions (FAQ)

1. What is the CME FedWatch Tool?

It is an analysis tool that calculates the probability of interest rate decisions from the Fed based on price data from Fed Funds futures.

2. Why do the probabilities of different sources vary?

Different institutions interpret market data and economic indicators in different ways, which is why we see variations between 75 % and 90 %.

3. How does an interest rate cut affect the stock market?

Usually positive, as lower interest rates reduce financing costs and make stocks more attractive.

4. What does PCE data mean for the Fed?

PCE (Personal Consumption Expenditures) is the Fed's favorite measure of inflation. Stable PCE data gives the Fed more freedom to lower interest rates.

5. Can the Fed refrain from cutting interest rates in September?

Yes, although the probability is low (15.6 % according to CME), the Fed may choose to wait for more data.

6. Will there be more interest rate cuts after September?

According to Barron's and Waller, another cut is likely to occur before the end of the year, depending on inflation and labor market developments.