Short summary

Despite some open positions with negative results, we have continued to deliver a strong overall performance: +7% in August and an accumulated development in SafeFXPro at +80.40% in 2023–2024, which far outperforms both the S&P 500 TR and OMXS30.

With our new strategy and the launch of SafeFXPro We are now strengthening the foundation for stable and disciplined returns going forward.

With our new strategy and the launch of SafeFXPro We are now strengthening the foundation for stable and disciplined returns going forward.

Analysis & Status Report

Historical

Recently, we have had several open positions with negative numbers, especially linked to the dollar (e.g. USD/CHF and USD/JPY). The significant dollar weakening that followed Trump's inauguration has negatively affected these positions.

Recently, we have had several open positions with negative numbers, especially linked to the dollar (e.g. USD/CHF and USD/JPY). The significant dollar weakening that followed Trump's inauguration has negatively affected these positions.

Despite this, we have continued to deliver strong results. For July, we made a return of 3,6% and August has so far delivered a return of +6,5 %.

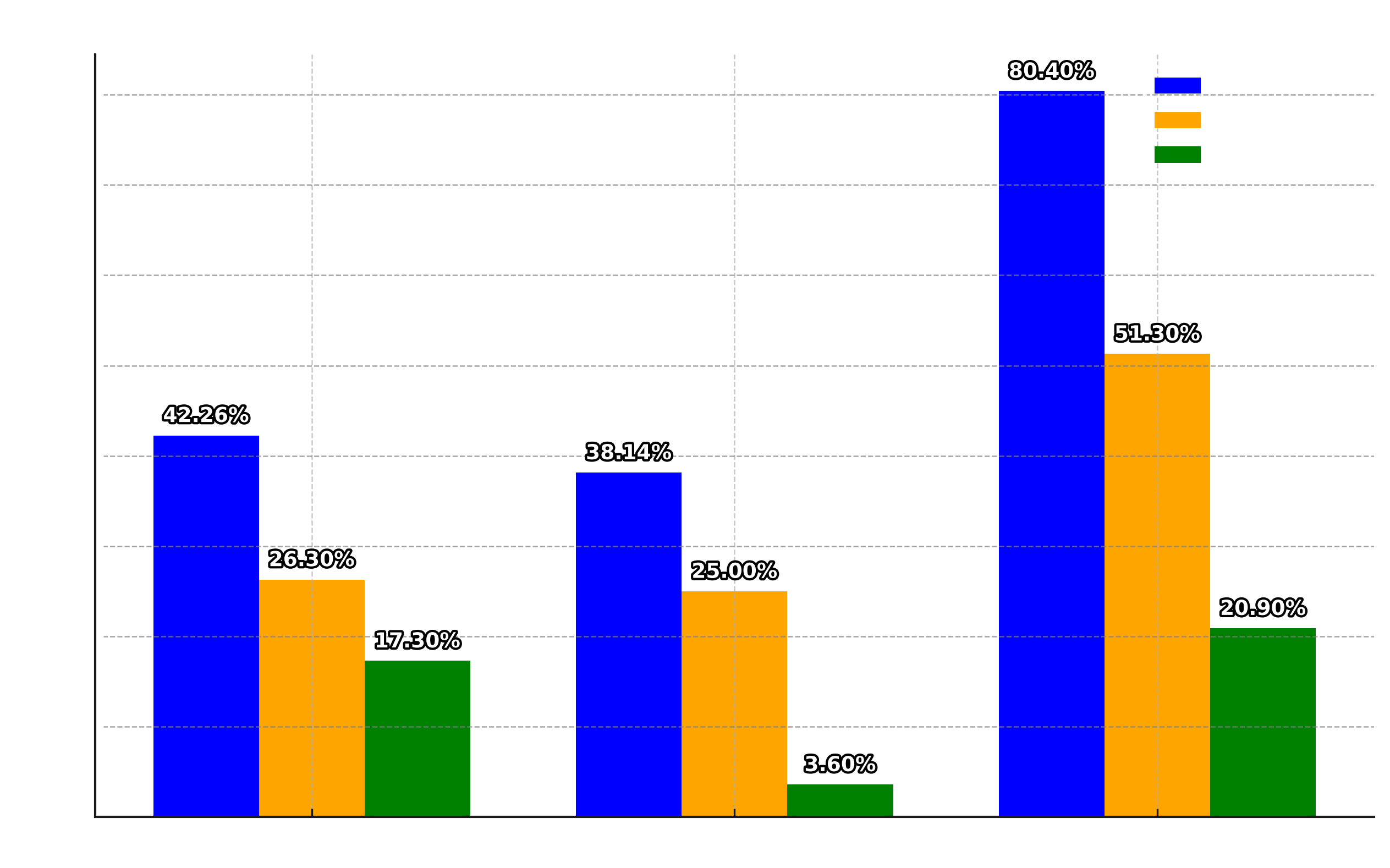

In particular, we would like to emphasize that SafeFXPro during the period 2023–2025 has demonstrated a clear ability to outperform leading market indices through its CFD-based strategy:

-

2023: +42.26 % (vs. S&P 500 TR +26.30 % / OMXS30 +17.30 %)

-

2024: +38.14 % (vs. S&P 500 TR +25.00 % / OMXS30 +3.60 %)

-

Cumulative 2023–2024: +80.40 % (vs. S&P 500 TR +51.30 % / OMXS30 +20.90 %)

-

2025 so far: +13 % (vs. S&P 500 TR approx. +9.7 % / OMXS30 approx. +5–6 %)

This clearly shows that even during periods of uncertainty, SafeFXPro has performed stronger than the market.

It is also important to remember that negative numbers in the portal do not correspond to realized losses – a loss only occurs when a position is actually closed.

It is also important to remember that negative numbers in the portal do not correspond to realized losses – a loss only occurs when a position is actually closed.

Future

Looking ahead, we see several positive factors. The US has indicated that further interest rate cuts may be in the offing in September. Such an announcement would likely strengthen the dollar, which could reduce our current losses and we aim for at least break-even on these positions.

Looking ahead, we see several positive factors. The US has indicated that further interest rate cuts may be in the offing in September. Such an announcement would likely strengthen the dollar, which could reduce our current losses and we aim for at least break-even on these positions.

We are also continuing to work on a new strategy focusing on gold. The strategy is based on two proven trading methods and has shown a total return of 333 %Going forward, it will be implemented at a quarter of the risk level, to provide a balanced combination of potential and security.

From Enkelinkomst to SafeFXPro

In connection with our development, we are now taking an important step: we are discontinuing Single income and instead launches SafeFXPro as our new name and brand.

The reasons are two:

Clarity & professionalism – we want to give our trading robot a name that reflects its function, focus on security and long-term growth.

Clarity & professionalism – we want to give our trading robot a name that reflects its function, focus on security and long-term growth.

International attractiveness – we are increasingly targeting international investors, and SafeFXPro is a name that works globally and strengthens our brand outside of Sweden.

International attractiveness – we are increasingly targeting international investors, and SafeFXPro is a name that works globally and strengthens our brand outside of Sweden.

With this, we have launched a new Facebook page and in the future we will publish all useful information on the new Facebook page. So we encourage everyone to join us on this:

The strategy going forward: SafeFXPro

SafeFXPro is our new main strategy – a hybrid based copy-trading system built for discipline, not drama.

Two engines – one common risk framework

-

Engine 1 – Trend-Pullback (with fixed stop-loss): Catches trends, uses strict stop-loss and takes profits quickly.

-

Engine 2 – Gold Cost-Averaging (with fixed take-profit): Trades only gold (XAUUSD), builds baskets with the maximum number of layers and closes the entire position at take-profit.

How they interact

-

Engine 1 captures trend movements, Engine 2 monetizes gold's rebounds.

-

Common risk rules limit bad days.

-

Together they provide broader market coverage than a single strategy.

Risk management in three levels

-

Position level (E1): Fixed stop-loss, limited number of trades.

-

Basket level (E2): Max stocks, volatility-based spacing, fast take-profit.

-

Account level: Daily loss limits with cooldown protection.

Investor profiles

-

Conservative: Engine 1 only (trend trading with fixed SL).

-

Active: Engine 2 only (gold trading with baskets).

-

Hybrid (recommended): Both engines – broader coverage, adapted risk.